north dakota sales tax rate 2021

2020 - Tax. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

North Carolina has 1012 special sales tax jurisdictions with local sales taxes in.

. The base state sales tax rate in North Carolina is 475. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. Combined with the state sales tax the highest sales tax rate in North Dakota is 85 in the city.

Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. North Dakota has recent rate changes Thu Jul 01 2021. Select the North Dakota city from the list of popular cities below to.

2021 - Tax Forms Instructions - Current Year. Gross receipts tax is applied to sales of. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 0959.

TAX DAY NOW MAY 17th - There are -406 days left until taxes are due. State Board of Equalization. The sales tax in North Dakota is 5 for most items.

The minimum combined 2022 sales tax rate for Raleigh North Carolina is. The Raleigh sales tax rate is. Sales tax total value of sale x sales tax rate.

Click here for a larger sales tax map or here for a sales tax table. Sales Tax Rate Lookup. Download sales tax lookup tool.

Did South Dakota v. North Dakota sales tax is comprised of 2 parts. All you need to do is enter your state and your city or county to find the right rate for you.

Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. This is the total of state county and city sales tax rates. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax.

Start filing your tax return now. North Dakota imposes a sales tax on retail sales. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. Look up 2022 sales tax rates for Raleigh North Carolina and surrounding areas. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the.

Find your North Carolina combined state and local tax rate. The sales tax is paid by the purchaser and collected by the seller. Since 1976 the highest that North Dakotas unemployment rate has reached is just 62 recorded in 1983.

Wayfair Inc affect North Carolina. Prescription Drugs are exempt from the North Carolina sales tax. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

The 2018 United States Supreme. State except neighboring South Dakota has had a higher unemployment rate during that period. You must file an amended North Dakota tax return when an item on your original return was reported incorrectly or to report changes made to your federal income tax return including changes made by the Internal Revenue Service.

With local taxes the total sales tax rate is between 5000 and 8500. The state sales tax rate in North Dakota is 5000.

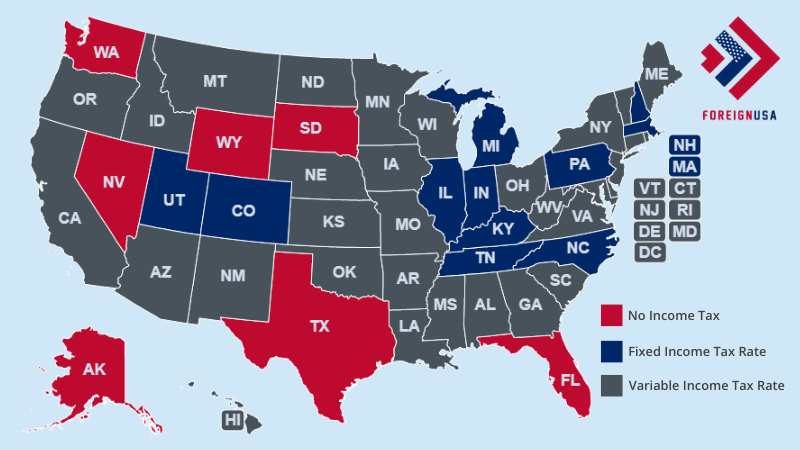

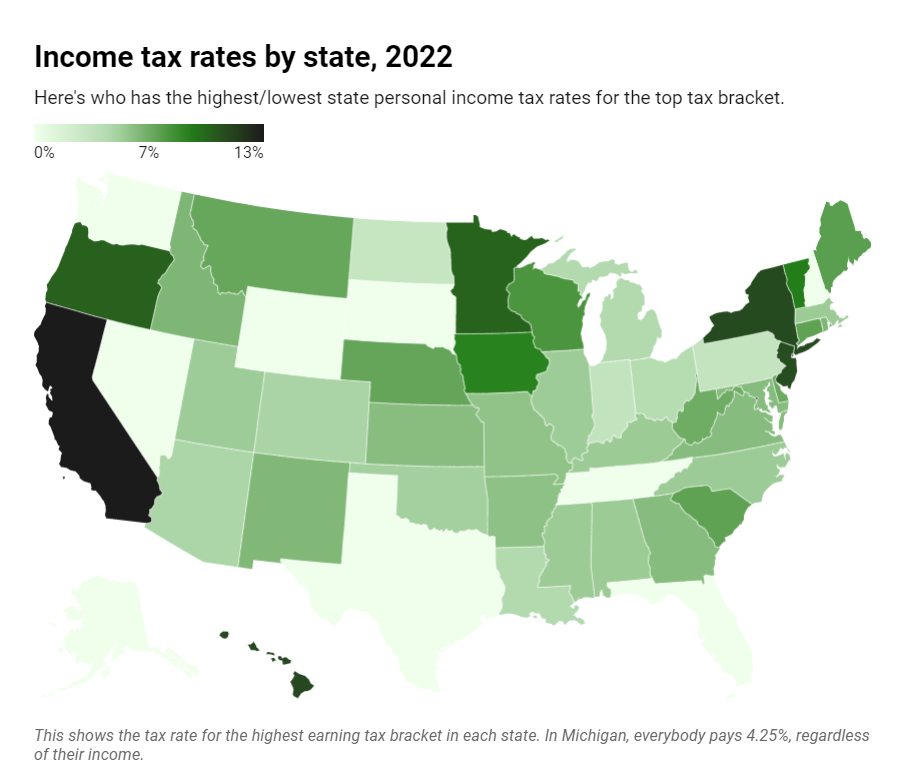

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Most And Least Tax Friendly Us States

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

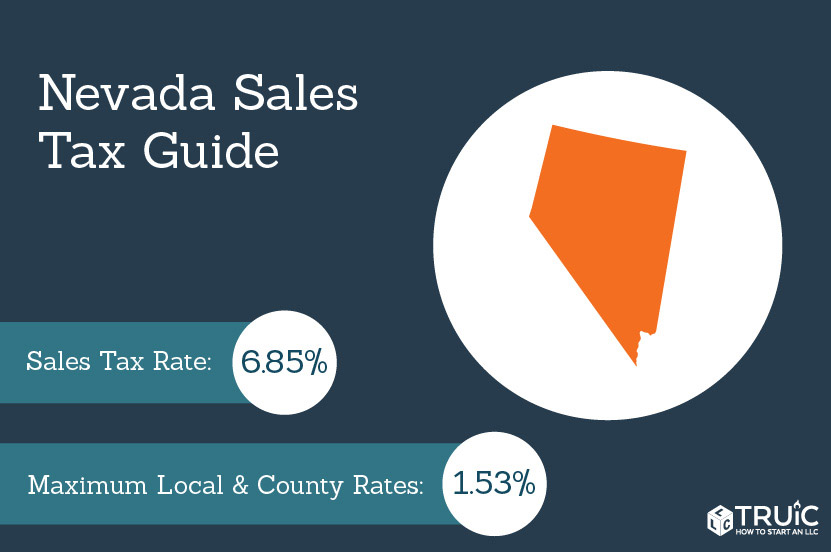

Nevada Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

State Income Tax Rates Highest Lowest 2021 Changes

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

North Dakota Sales Tax Rates By City County 2022

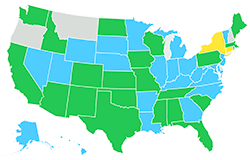

Sales Tax On Grocery Items Taxjar

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com